Fresh Nuggets - Nassim Taleb | 3 Cognitive Biases That are Making You Poor and Unhealthy + How To Overcome Them

Hey friend!

In this article, we will go through 3 important Cognitive Biases that are creating a tendency to..

1) Seek small frequent gains while ignoring big unfrequent risks (opposite of antifragility)

2) Be consistent with our habits and beliefs

3) Avoid discomfort all together -- we can't fine-tune that a certain amount of variability or randomness is beneficial to us.

I took notes on this from a conversation between Nassim Taleb and Daniel Kahneman, and from Mohnish Pabrai who appeared on a recent talk.

Here is the full version of my notes and reflections...

🧠 Quotes

“The three most harmful addictions are heroin, carbohydrates, and a monthly salary.” - Nassim Nicholas Taleb.

“If you’re willing to bleed a little bit every day but in exchange you’ll win big later, you will do better. That is, by the way, entrepreneurship. Entrepreneurs bleed every day. They’re not making money, they’re losing money, they’re constantly stressed out, all the responsibility is upon them, but when they win they win big. On average they’ll make more.” - Naval Ravikant

👨 People

Nassim Taleb

Nassim Taleb's work concerns problems of randomness, probability, and uncertainty. Author of many successful books, including The Black Swan, which The Sunday Times considers one of the 12 most influential books since World War II.

Daniel Kahneman (source: wikipedia)

Daniel Kahneman is notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences (shared with Vernon L. Smith). His empirical findings challenge the assumption of human rationality prevailing in modern economic theory.

Mohnish Pabrai

Mohnish Pabrai is a renowned investor and entrepreneur. He currently manages around 600-800m$ in his Investment Fund. He also started the NGO "Dakshana" in India (2008), which coaches students to pass the university entrance exams for IT and Medicine. He has a close friendship with Charlie Munger.

🐨 Summary

1) Prospect Theory

As the magnitude of the loss/gain increases… Our capacity to feel the pain/pleasure decreases.

It will make you Less *Objective* and *Antifragile*.

2) Consistency Bias

Anything we think or do… We will tend to make it consistent with our habits and beliefs.

3) Bias to Avoid Discomfort

We are programmed to avoid discomfort (variability), but we *need* it to get better.

📝 Notes

Chapter 1: Nassim Taleb & Daniel Kahneman

1) The Prospect Theory (2002 Nobel Prize in Economics)

We are more sensitive to small losses/gains than to big losses/gains.

As the magnitude of the loss/gain increases --> our capacity (or sensitivity) to feel the pain/pleasure decreases.

1.1) Maximizing Pleasure and Minimizing Pain(Basis for Fragility)

1.1.1) Gains

"You would rather make a million over a year in small amounts." - Nassim Taleb

You feel more pleasure from making a small gain many times than to make all the gain at once (even though the total accumulated amount gained is exactly the same!).

1.1.2) Losses

"If you are gonna lose money or have a bad event, have it all at once. You would rather lose a million dollar (all) in one day, than lose a little bit of money (many times)" - Nassim Taleb

You feel less pain from losing it all at once than to lose a bit many times (even though the total accumulated amount lost is exactly the same!)

(Picking Nuggets note:

Some issues with falling prey to this Bias...

It will cause to make poorer decisions. Because it increases the mismatch btw your perception of reality and the actual reality. And if you can't see reality the way it is, you can't have good judgement (critical for success).

"A clear mind leads to better judgement, (which) leads to better outcome. So a calmed / peaceful person will make better decisions and have better outcomes. So if you wanna operate at peak performance, you have to learn how to tame your mind." - Naval Ravikant (Joe Rogan's Podcast)

You will become more "fragile". Because you will tend to prefer to win as many times as possible, and avoid any kind of pain/stressor. This is the opposite of what Nassim calls "Antifragile", which he argues is the best way to approach life.

)

To successfully follow Taleb's Antifragile prescriptions, you can't fall prey of the Prospect Theory!

Antifragility --> To embrace many small losses so you can have a one-off big gain. Or to forgo small gains so you are not exposed to a one-off big loss.

2) The Consistency Bias

When we think or do anything, we try to make it consistent with our past habits and beliefs. Thus, we never really expect the big event to ever happen, because we (likely) haven't experienced any previous big event yet.

So we are biased to (unintendedly) create a big potential risk (e.g./ getting a big debt) for small gains in the present.

It's like the turkey that falls in love with the butcher until Thanksgiving day comes (core idea behind Nassim's book The Black Swan --> Do not be the Turkey!).

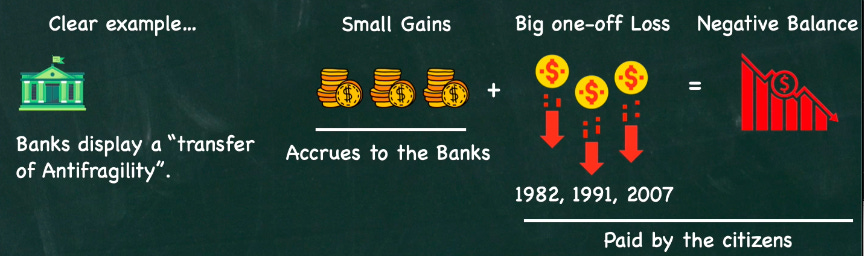

Instance: The Banking System (represents very well these Biases)

Small frequent gains

Big unfrequent loss (when a Crisis hits)

The Issue...

The loss wipes out all previous gains and leaves a net negative.

In a quarter of 1982, bankers lost more money than they made in all the history of Banking. This would happen again in 1991 and 2007.

How they survive?? -- In the case of Banks it's a special case (which the rest of businesses and individuals do not have)

When they lose... Citizens subsidize the losses.

When they make money... they make money for them.

This is what Nassim calls "Transfer of Antifragility".

3) Bias to avoid immediate discomfort / seek immediate pleasure

"A system that does not convert stressors/problems/variabilities into fuel is doomed" - Nassim Taleb

"A blazing fire makes flame and brightness out of everything that is thrown into it. The impediment to action advances action. What stands in the way becomes the way." - Marcus Aurelius (Meditations)

The Inner Struggle...

We *need* variability (within a healthy range), but we are programmed (by evolution) to avoid it and seek comfort.

We are not fine-tuned to understand that variability/randomness/stressors in small amounts is beneficial to us.

(Picking Nuggets note: Also, we tend to see it black and white: Extreme comfort won't kill us. But extreme stressors will! So this causes us to go all in with comfort and avoid randomness AMAP! But when we do this, we miss on the gains that can come from overcoming healthy amounts of randomness/stress.)

Chapter 2: Mohnish Pabrai

“Anything that has more upside than downside from random events (or certain shocks) is antifragile; the reverse is fragile.” - Nassim Taleb (Book: “Antifragile”)

To reduce the negative effects from the Prospect Theory Bias... Consciously try to engage in antifragile behaviors and activities…

Charlie Munger and Mohnish Pabrai consciously try to follow this idea of Antifragility. They call it “Asymmetry”.

Do things which have an ASYMMETRY (in the risk/reward ):

Downside is small or non-existent

Upside is unknown and unlimited.

Get use to making "small bets" --> embrace small frequent losses so you can have a huge unfrequent gain.

Check out the YouTube video I created on this (same content, but with more visuals/animations):

https://www.youtube.com/watch?v=1q-CubomEJg&ab_channel=PickingNuggets

💬 Reflections

Loss Aversion

Besides the distortion in sensitivity caused by the magnitude level of the gain or loss, we can also notice another important Bias in the graph: And that is that for the (same) unit of loss/gain We feel more the pain than the happiness. This Bias is called Loss Aversion. This is one of the most important biases in human nature and it explains a great deal of our reactions.

This is why it is said that 70% of all consumer purchases are done to avoid a loss and 30% to get a positive/benefit (according to ex FBI negotiator and business leader Chris Voss). Or, to some extent, why people are afraid of variability in general -- So afraid that in the financial markets people often even use volatility (that is, the fluctuation of prices) as a measure of risk, which in an objective sense doesn't make any sense because real risk is only a permanent loss of capital.

Embracing Randomness...

Having some variability in the sense of adventure in your life is also way more fun than having a monotonous life in which you already know what you are gonna be doing at each hour or minute of your day. This is what Nassim calls "touristification of your own life" --> Just like in a tour everything has a specific time in the schedule. Your life becomes a tour in itself if you already know in advance what you will be doing at each moment of your day. Also, having everything timely planned makes you more "fragile", because an unexpected event can only be negative (that is, there is only downside). Whereas if you are adventurous, unexpected events will definitely have more upside than downside.

Some aphorisms from Nassim Taleb on this...

"If you know, in the morning, what your day looks like with any precision, you are a little bit dead – the more precision, the more dead you are."

“You have a calibrated life when most of what you fear has the titillating prospect of adventure.”

The Prospect Theory and Consistency Bias

The Consistency Bias makes the Prospect Theory even more powerful! -- We think that the big unfrequent event (positive or negative) will never happen, so we don't seek the big potential pay-off or prepare ourselves for a big potential loss. And we get complacent with the small frequent gains to feel like we are doing well (maximizes pleasure) and we are "in the right path" and everyone in our social circle respects/accepts us (not only because you are often winning, but also because most people will choose this path).

Falling prey of the Prospect Theory and Consistency Bias will make you way more likely to find and stay in a "stable" job, rather than starting an entrepreneurial venture.

If you are an employee, you have small frequent gains (your monthly salary). You feel good because you are feeling the pleasure of the gain in many doses, but you also set up the potential big event of losing your job and even defaulting on your mortgage if you got any. Maybe this structure of having "certain" and frequent gains is one motive for Nassim's aphorism:

“The three most harmful addictions are heroin, carbohydrates, and a monthly salary.” ― Nassim Nicholas Taleb.

If you are an entrepreneur, you are "bleeding" a bit every day, but you also set yourself up to profit from a big unfrequent gain at some point in the future. And also because the upside potential in entrepreneurship is unlimited, you could make way more money than the accumulated small gains of a corporate job. In terms of biased feelings, you feel bad everyday and the day you win big you don't feel it that much because our - sensitivity to feel - decreases. So it sucks from a feelings perspective, but in absolute terms (in terms of financial freedom or freedom in general) I think you are way better off.

“If you’re willing to bleed a little bit every day but in exchange you’ll win big later, you will do better. That is, by the way, entrepreneurship. Entrepreneurs bleed every day. They’re not making money, they’re losing money, they’re constantly stressed out, all the responsibility is upon them, but when they win they win big. On average they’ll make more.” - Naval Ravikant

The Fresh Nuggets (Newsletter) is brought to you by Shortform

Shortform is THE platform to go if you wanna find highly valuable nuggets (big ideas) from important non-fiction books. Beyond offering book summaries, they provide you with a full guide and synthesis of all the worthy ideas in a book. Personally, I love it because I can absorb book ideas at a faster pace compared to reading the entire books, and there is a deep analysis on each idea! (it is not shallowly explained, as it is the case in other platforms).

(Many times book authors will make hundreds of pages based on just a few new ideas just for the sake of producing a book, but in reality they could have given you these new-interesting ideas in just few pages. This is the cool thing about Shortform: you cut to the chase and get the book insights without having to go thru unnecessary extensions of them. Besides, in any book guide on Shortform you can find links to blogposts related to the same ideas! -- as Naval Ravikant argues: reading books to completion is more of a vanity metric. What actually matters is to look for ideas, and once you find good interesting ideas, you reflect and research on them. [Naval on the podcast with Joe Rogan]. And it is the foundational understanding of all these truthful and interdisciplinary ideas that will make you better in any life dimension [Charlie Munger, Warren Buffet, Naval Ravikant]).

Besides, I have found at least 50-60 books (on Shortform) that were on my personal reading list. These include 4 popular books of Nassim Taleb:

So you will likely find many interesting book guides on Shortform! My plan is to read these book guides and if in a particular one I find a super interesting-new idea to me, I will also buy the book and read it entirely!

If you wanna check out Shortform, you can use my special link to support the channel and you will have a 5-day FREE trial and a 20% off the annual subscription - shortform.com/pickingnuggets

The mark of a great (non-fiction) author...

👨💻Other content I have found pretty cool and valuable this week

The Modern Struggle - Naval Ravikant — www.youtube.com Naval Ravikant is a technology entrepreneur well known for his role as a founder and the Chairman of AngelList. This audio is from his podcast with Joe R...

The Art of Making Decisions - Alan Watts — www.youtube.com Speech extract from "Do You Do It or Does It Do You?: How to Let the Universe Meditate You" by Alan Watts, courtesy of https://alanwatts.org Alan Wilson Watt...

Joe Rogan Explains Why He Doesn’t Set Goals in Life. W/ Steven Pressfield — www.youtube.com

🌈 Join our Community on Discord - link

Until next time,

Julio xx

PS: If you opened this article from the YouTube video, consider subscribing to receive them in future!